The Basic Principles Of Baron Tax & Accounting

Getting The Baron Tax & Accounting To Work

Table of ContentsBaron Tax & Accounting - QuestionsA Biased View of Baron Tax & AccountingSome Known Details About Baron Tax & Accounting Little Known Questions About Baron Tax & Accounting.7 Simple Techniques For Baron Tax & Accounting

Plus, accountants are expected to have a decent understanding of maths and have some experience in an administrative role. To become an accountant, you have to have at the very least a bachelor's degree or, for a higher degree of authority and knowledge, you can become a public accountant. Accountants have to likewise satisfy the strict needs of the accountancy code of technique.

The minimal qualification for the certified public accountant and ICAA is a bachelor's level in accounting. This is a beginning factor for refresher course. This guarantees Australian company owner get the very best feasible monetary recommendations and administration possible. Throughout this blog, we have actually highlighted the large distinctions in between bookkeepers and accountants, from training, to duties within your company.

Get This Report about Baron Tax & Accounting

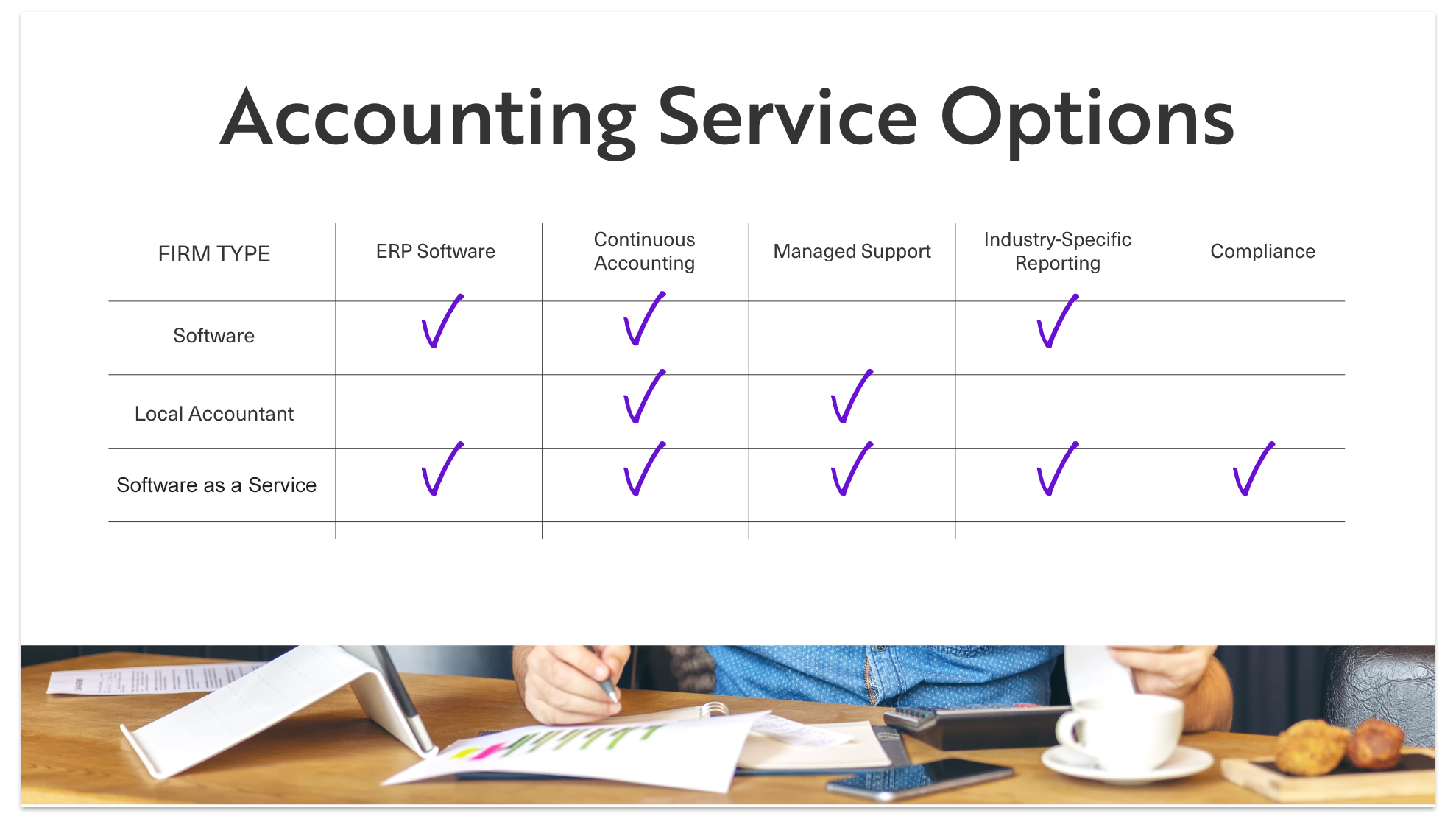

The solutions they give can optimize profits and support your financial resources. Businesses and individuals must take into consideration accountants a critical aspect of economic preparation. No accounting firm provides every service, so ensure your experts are best fit to your certain demands.

(https://giphy.com/channel/baronaccounting)

Accounting professionals are there to calculate and update the set quantity of cash every employee obtains consistently. Bear in mind that holidays and sicknesses impact pay-roll, so it's a component of the business that you have to regularly upgrade. Retirement is likewise a significant element of pay-roll monitoring, especially considered that not every staff member will wish to be registered or be eligible for your firm's retirement matching.

The smart Trick of Baron Tax & Accounting That Nobody is Discussing

Some lending institutions and financiers need crucial, calculated choices between the organization and investors following the conference. Accountants can also exist right here to assist in the decision-making procedure. Prep work entails issuing the earnings, cash circulation, and equity statements to assess your existing monetary standing and condition. It's easy to see exactly how complicated bookkeeping can be by the variety of abilities and jobs called for in the function.

Little organizations often encounter special economic blog here obstacles, which is where accountants can provide important assistance. Accountants offer a range of services that aid organizations stay on top of their finances and make educated decisions. claim tax refund online Australia.

Thus, expert accounting aids stay clear of expensive errors. Pay-roll management includes the management of staff member earnings and salaries, tax deductions, and benefits. Accountants guarantee that staff members are paid accurately and on schedule. They compute pay-roll taxes, manage withholdings, and make certain conformity with governmental policies. Processing paychecks Taking care of tax obligation filings and repayments Tracking staff member advantages and deductions Preparing pay-roll records Appropriate pay-roll management prevents problems such as late repayments, wrong tax obligation filings, and non-compliance with labor legislations.

Some Known Facts About Baron Tax & Accounting.

This action reduces the danger of errors and possible penalties. Small company owners can count on their accounting professionals to manage complicated tax obligation codes and regulations, making the declaring procedure smoother and much more effective. Tax planning is an additional vital solution given by accounting professionals. Reliable tax preparation entails planning throughout the year to lessen tax obligation responsibilities.

These services commonly concentrate on service assessment, budgeting and projecting, and money circulation management. Accountants help local business in figuring out the well worth of the business. They examine possessions, responsibilities, revenue, and market conditions. Techniques like,, and are made use of. Accurate appraisal aids with marketing the business, safeguarding lendings, or drawing in capitalists.

Explain the procedure and solution questions. Take care of any inconsistencies in documents. Guide local business owner on finest practices. Audit support assists companies experience audits efficiently and successfully. It decreases anxiety and mistakes, making certain that organizations meet all essential laws. Statutory conformity includes sticking to legislations and laws connected to company operations.

By setting reasonable monetary targets, companies can designate sources successfully. Accountants guide in the implementation of these methods to ensure they align with the organization's vision.

The 10-Minute Rule for Baron Tax & Accounting

They assist in establishing inner controls to stop fraud and errors. Additionally, accountants encourage on conformity with lawful and regulative demands. They ensure that organizations adhere to tax regulations and industry regulations to avoid penalties. Accounting professionals also advise insurance policies that use defense versus possible threats, making certain the business is guarded versus unforeseen occasions.

These devices assist little organizations maintain exact records and enhance procedures. It aids with invoicing, payroll, and tax prep work. It supplies numerous functions at no cost and is suitable for startups and little services.